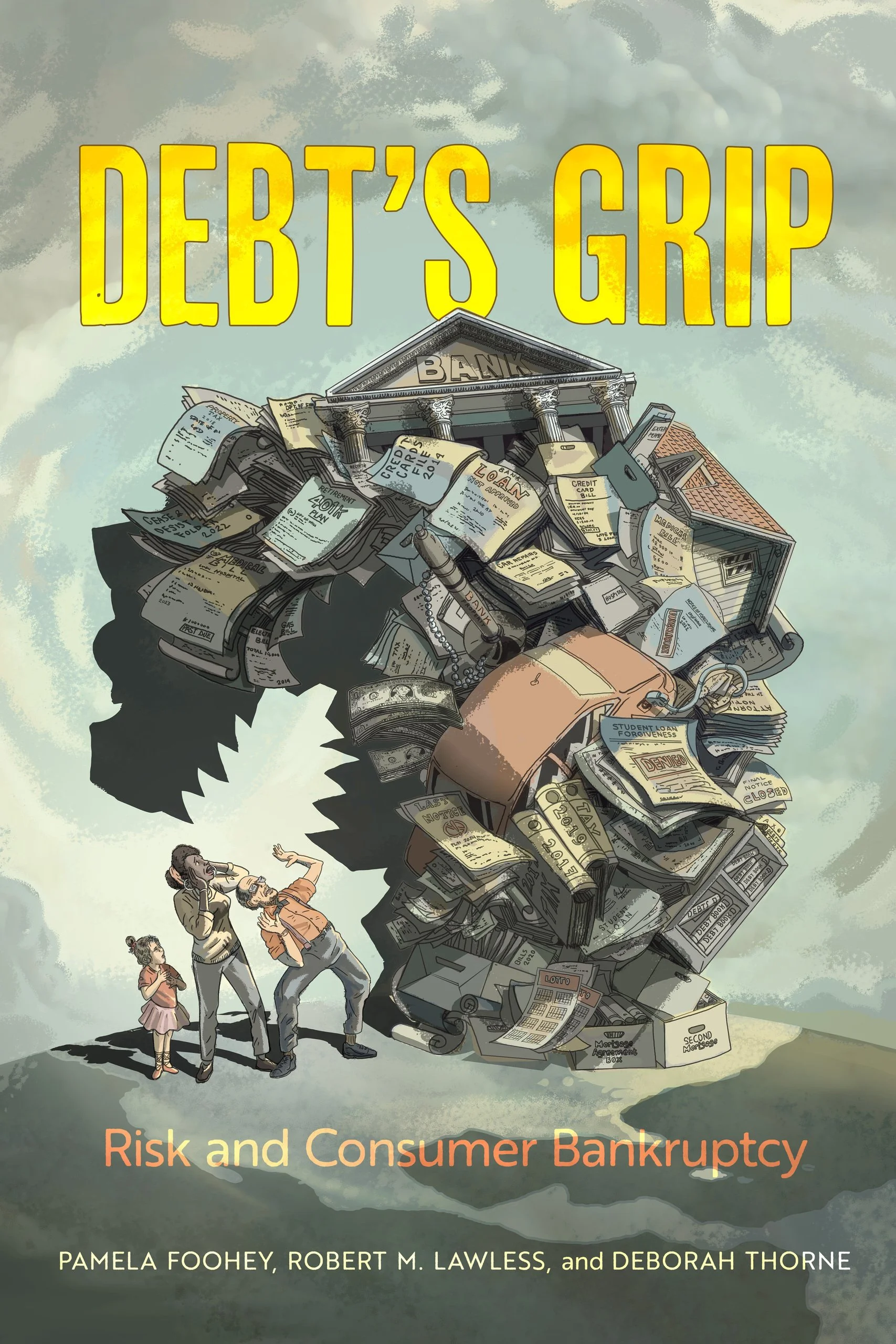

Cover art by Avi A. Katz

Released August 2025

Debt’s Grip: Risk and Consumer Bankruptcy

Debt’s Grip tells the story of financial struggle in the United States. Drawing on original data from the Consumer Bankruptcy Project, a landmark long-term study, the authors use the words of bankruptcy filers themselves to shed light on their battles to keep their homes and their cars, pay for healthcare and higher education, care for their children, find adequate employment, retire, negotiate with debt collectors, and confront discrimination in lending. Laying bare the consequences of risk privatization, this book makes a powerful case for why the United States must confront the structural inequities that cause so many—especially Black families, women, and the elderly—to struggle in today’s economy.

Book Conference: October 10, 2025

Financial Precarity in the United States — A Discussion of Debt’s Grip: Risk and Consumer Bankruptcy

This conference, hosted by University of Georgia School of Law, celebrates the publication of Debt’s Grip: Risk and Consumer Bankruptcy. It brings together the book's authors and thought leaders from a variety of fields for a day filled with discussion and insights about household financial precarity in the United States. For more information about the conference, visit its website.

Reviews in American Bankruptcy Law Journal, Issue 99:3 (2025)

Alexandra Sickler, “Surviving on the Financial Edge”

Ted Janger, “Consumer Bankruptcy, Household Debt and the Big Picture”

Our response: Pamela Foohey, Robert M. Lawless, & Deborah Thorne, “Anecdotes on the Data in Debt’s Grip”

Reviews

Nicholas Glover’s review of Debt’s Grip in the December 2025 issue of the American Bankruptcy Institute Journal

"Almost unseen by anyone but a cadre of specialized lawyers, people in bankruptcy number in the millions. Grounded in data analysis, Debt’s Grip brings to life the stories of those who solved their problems in the most modern and American of ways—by borrowing. Bankruptcy shows us the underbelly of consumer lending, the pain of people who collectively are the reality of macroeconomic trends like consumer spending and inflation. This book points squarely to the hardships that should center debate about what a thriving economy looks like or what constitutes an adequate social safety net."

—Katie Porter, former US Representative and Professor of Law, UC Irvine School of Law

"Transforming cold statistics into heartbreaking stories of the people who file for bankruptcy, Debt's Grip is an important corrective to the many falsehoods that portray debtors as mere deadbeats, showing that those who seek bankruptcy protection—inadequate as it may be—have been left without alternatives by catastrophes and systemic societal failures."

—Edward Boltz, attorney and former President of the National Association of Consumer Bankruptcy Attorney

"Debt’s Grip vividly illustrates how Americans are struggling to pay their bills, gripped by fear and shame, because this country fails to provide a humane social safety net—leaving far too many of our most vulnerable citizens to fend for themselves."

—A. Mechele Dickerson, author of The Middle-Class New Deal: Restoring Upward Mobility and the American Dream

"Deeply researched, powerfully argued, and frequently moving, Debt’s Grip lays bare how the ever-growing financial precarity of American workers and their families affects us all. An essential guide to US economic discontent—and what must be done to reverse it."

—Jacob S. Hacker, author of The Great Risk Shift: The New Economic Insecurity and the Decline of the American Dream

"Grounded in meticulous interdisciplinary research, Debt's Grip is an accessible and essential resource documenting the broad but uneven distribution of precarity in America."

—Melissa B. Jacoby, author of Unjust Debts: How Our Bankruptcy System Makes America More Unequal

“Through meticulous analysis of bankruptcy court records and surveys, this compelling book reveals how decades of policy choices have pushed financial risk onto everyday Americans, creating widespread economic precarity. Charting surveys and their meticulous review of bankruptcy court records, the authors masterfully demonstrate how bankruptcy filings illuminate broader societal failures that leave millions struggling to survive.”

—Christopher K. Odinet, author of Foreclosed: Mortgage Servicing and the Hidden Architecture of Homeownership in America

“Anyone serious about finding solutions to today’s problems must read this book. Consumer debt is key to understanding the lives of many Americans, and no other book tells this story of personal struggle, sacrifice, tragedy, and hope with such clarity.”

—John Rao, Senior Attorney, National Consumer Law Center

"This timely and incisive book reveals the lived experience of financial precarity and the impact on ordinary people and daily life of the retreat of social policy from key issues of making a living, having a place to live, and caring for those who depend on us. A readable and thought-provoking study that will engage readers interested in big questions of inequality and social policy as well as those interested in bankruptcy."

—Rebecca Sandefur, sociologist and MacArthur Fellow

Reporting on Debt’s Grip

Talks

Law and Society 2026 Annual Meeting (May / June 2026)

American College of Bankruptcy, Class 37 Induction and Events (March 2026)

Eighth Annual Consumer Law Scholars Conference (March 2026)

Idaho State Bar, 44th Annual Commercial Law & Bankruptcy Seminar (February 2026)

The Ohio State Moritz University College of Law, Health Law Colloquium (February 2026)

American Association of Law Schools 2026 Annual Meeting (panels with Section on Socio-Economics, Law and the Social Sciences, and Creditors’ and Debtors’ Rights) (January 2026)

University of Illinois College of Law, Bankruptcy Day / Book Launch (November 2025)

American Bankruptcy Law Journal Roundtable (October 2025)

National Association of Consumer Bankruptcy Attorneys (NACBA), Members- Only Fall Workshop (October 2025)

Berkeley Judicial Institute (August 2025)

State Bar of Montana, Bankruptcy Law Section 2025 Annual Meeting (July 2025)

Society for the Advancement of Socio-Economics, 37th Annual Meeting (July 2025)

The American Society of Law, Medicine and Ethics, 48th Annual Health Law Professors Conference (June 2025)

Brooklyn Law School, Debt in the Real World Symposium (March 2025)

Duke University School of Law, Poverty Law (February 2025; March 2024) and Bankruptcy Seminar (February 2025)

State Bar of Georgia, Consumer and Business Bankruptcy Institute (December 2024)

Brooklyn Law School, Consumer Law Seminar (October 2024)

Southeastern Association of Law Schools, 2024 Annual Meeting (July 2024)

Minnesota Law, Faculty Colloquium (September 2023)

Northeastern University School of Law, Faculty Colloquium (April 2023)

Law and Society Association, 2022 Annual Meeting (July 2022)